General Expenditures - Examples of Allowable and Unallowable Costs

All expenditures must be reasonable, allowable, and allocable. The following examples provide guidance on common and special situations for allowable and unallowable uses of Child Nutrition program funds. (Tip: CTRL + F to search easier.)

Common Expenditures

Advertising, Disposing of Surplus Materials

- Allowable - materials and expenses to obtain services to properly dispose of surplus materials

Advertising, Outreach

- Allowable - materials and expenses for communication with parents and the community about program activities and services

- Unallowable - materials and expenses for public relations materials or activities designed solely to promote the SFA and not promote child nutrition program(s) the SFA operates

Advertising, Procurement

- Allowable - materials and expenses to publicize procurement solicitations

Advertising, Recruitment

- Allowable - materials and expenses to recruit personnel

Contributions

- Unallowable - contributions of cash, property, and services by the SFA to another entity

Equipment, Disposal of Equipment

- Allowable - costs associated with the disposal or transfer of equipment if the SFA is instructed by NYSED to dispose of the equipment

Equipment, Expendable Equipment and Other Supplies

- Allowable - materials or supplies used specifically in the SFA operation, including items that must be replaced from time to time: pots and pans, serving trays, dishes, glassware, silverware, linen, mops, brooms, and cleaning supplies

Equipment, Nonexpendable Items

- Allowable - items or equipment used directly in preparing, storing, or serving meals (see pre-approved equipment list)

Equipment, Office Equipment

- Allowable - items used to support program goals and objectives including cash registers, adding machines, software, communication equipment, and other equipment used exclusively for the SNP operation as well as maintenance, upkeep, and repair of allowable office equipment

Equipment, Office Equipment, Cell Phone

- Allowable - cell phones and cell phone expenses if the cell phone contract is in the SFA’s name and not in the name of the individual employee using the cell phone

- Unallowable

- Cell phones and cell phone expenses considered to be a stipend or allowance

- Cell phones and cell phone expenses purchased and registered in the name of the employee

Equipment, Computers

- Allowable - computers/computing devices that are essential to program operation

Facilities, Improvement, Rearrangement, and Reconversion

- Allowable - supplies, equipment, and labor costs associated with facility improvement, rearrangement, and reconversion with NYSED approval before incurring the cost

- Unallowable - costs associated with remediation or repair to a school building (i.e. plumbing, heating, air conditioning) would add to the permanent value of the school building and are therefore unallowable. These costs should be borne by the School Food Authority's general fund.

Facilities, Insurance

- Allowable - premiums for covering CN property in connection with general operations and sound business practices or premiums for insurance that the SFA is required to carry by federal, state, or local regulation or law

- Unallowable - loss resulting from failure to maintain insurance as prescribed by regulation

Facilities, Land Purchase, Acquisition, and Construction*

- 7 CFR 210.14(a) and 220.7(e) require that revenue received by the nonprofit school food service account are to be used for only for the operation and improvement of the food program and such revenue shall not be used to purchase land or buildings unless otherwise approved by FNS, or to construct buildings. Historically, FNS has not approved the cost of building purchases because program funds are made available to help support the costs of nutritional benefits for children in school settings and not to construct school related facilities.

- The costs of building a kitchen are similar to the costs of constructing school buildings, which historically have been supported by the school district with general or capital improvement funds.

Facilities, Rental of Facilities or Equipment

- Allowable - rental or lease fees for non-SFA owned facilities such as cafeterias, kitchens, or storage facilities required for specific program needs

- Unallowable - rental or usage fees for SFA-owned equipment or facilities such as cafeterias, kitchens, or storage facilities

Facilities, Security

- Allowable - expenses for the protection and security of facilities, personal, and work products including wages and uniforms of personnel engaged in security activities, equipment, barriers, and contracted services

Facilities, Services

- Allowable - services which are necessary for the operation of the program, including services such as pest control, trash removal, security, and janitorial

Facilities, Utilities

-

Allowable – actual costs accounted for separately or prorated for the food service program. SFAs must determine if the cost is classified as direct or indirect

-

Direct – Meter for kitchen/serving area

-

Total billed amount allowable

-

-

Indirect – One meter for entire school

-

Billed amount must be prorated based on the SFAs current indirect cost rate

-

-

Financial, Audits

- Allowable - cost for audits conducted in accordance with program requirements or a proportional share of the costs of audits (if the audit covers non-Child Nutrition programs) conducted in accordance with program requirements

- Unallowable - cost for any audit not conducted in accordance with requirements

Financial, Cost Sharing

- Unallowable - charging any items or services that are part of cost sharing or matching requirement to the food service account

Financial, Depreciation

- Allowable - depreciation or use allowances based on a straight-line calculation method (the pattern of consumption of the asset) that have a useful life of more than one year for assets purchased after December 26, 2014 or another method which allows the SFA to demonstrate with clear evidence that the expected pattern of consumption would be greater in the earlier portions of the asset’s useful life

- Unallowable -

- Depreciation calculated by any method other than a straight-line calculation for items purchased after December 26, 2014 unless the SFA can demonstrate with clear evidence that the expected pattern of consumption would be greater in the earlier portions of the asset’s useful life

- Depreciation recorded on the cost of land; any portion of the cost of a building donated by the federal government no matter where the title was originally vested

- Depreciation for any asset purchased with restricted program funds

- Depreciation for any asset that has been paid for in full though payments were made over more than one fiscal year

- Depreciation for any asset that has outlived its depreciable life

- Depreciation for any asset that is paid for in full in the current fiscal year

Financial, Improperly Procured Products or Services

- Unallowable - costs incurred as result of improperly procured products and/or services whether the cost was incurred as a result of micro-purchase, small purchase, invitation for bids, or request for proposals methods of purchasing

Financial, Interest

- Allowable - interest at the prevailing loan rate

- Unallowable -

- Interest costs for the use of the program’s own funds

- Expenses used for lobbying and membership in an organization that devotes substantial activities to lobbying and influencing legislation

Financial, Scholarship

- Unallowable - use of funds from any Child Nutrition program payments, rebates, credits, or other income for student scholarships

Financial, School Improvement

- Unallowable - use of funds from any Child Nutrition program payments, rebates, credits, or other income for school improvement expense

Food Operation, Food Service

- Allowable - food purchases and costs directly related to the storage, handling, processing, and transportation of food

Fundraising, Actions to Raise Funds for the Program

- Allowable -

- Costs related to the physical custody and control of monies and securities that result from fundraising

- Costs for the purposes of meeting the Federal program objectives are allowable with prior written approval from the Federal awarding agency

- Unallowable -

- Costs of organized fundraising, including financial campaigns, endowment drives, solicitation of gifts and bequests, and similar expenses incurred to raise capital or obtain contributions

- Costs of investment counsel and staff and similar expenses incurred to enhance income from investments are unallowable except when associated with investments covering pension, self-insurance, or other funds which include Federal participation allowed by this part

Legal Expenses, Attorney's Fees

- Allowable -

- Appropriate fees that are consistent with normal program operations

- SFAs must consult with CNPA when there is a question as to whether the fee supports normal program operations.

- Appropriate fees that are consistent with normal program operations

- Unallowable - costs incurred in the defense of any civil, criminal, or administrative fraud proceeding or similar charge

Legal Expenses, Fines and Penalties

- Unallowable - fines, penalties, damages, or other settlements resulting from violations or alleged violations of, or failure of the entity to comply with, federal, state, local, or other government agencies

Lobbying, Political Activities and Events

- Unallowable -

- Expenses used to influence the outcomes of any federal, state, or local election, referendum, initiative, or similar procedure, through in-kind or cash contributions, endorsements, publicity, or similar activity

- Expenses used to establish, administer, contribute to, or pay the expenses of a political party, campaign, political action committee, or other organization established for the purpose of influencing the outcomes of elections in the United States

- Expenses used in an attempt to influence the introduction of federal or state legislation; the enactment or modification of any pending Federal or state legislation through communication with any member or employee of the Congress or state legislature (including efforts to influence state or local officials to engage in similar lobbying activity); or any government official or employee in connections with a decision to sign or veto enrolled legislation

- Expenses used to attend a legislative session or committee hearing with the intent of gathering information regarding legislation and analyzing the effect of legislation when such activities are carried on in support of or in knowing preparation for an effort to engage in unallowable lobbying

Outreach and Public Relations, Committees

- Allowable - expenses for organizing or activities related to committees or councils that increase outreach and promote program involvement

Outreach and Public Relations, Incentives/Prizes to Participating Families

- Allowable - reasonable incentives to encourage households to return completed free and reduced-price meal applications

Outreach and Public Relation, Promotional Materials

- Allowable -

- Exhibits or other information sharing activities related specifically to Child Nutrition programs as well as printed materials to communicate information and messages central to program operations and program mission

- Activities to maintain and promote understanding and favorable relations with the community or public at large or any segment of the public

- Unallowable - any promotional materials or activities for purposes other than those described as allowable. This includes the following types of costs:

- Meetings, conventions, and convocations

- Cost of displays, demonstrations, and exhibits, meeting rooms, hospitality suites, and other special facilities used in conjunction with shows and other special events

- Salaries and wages of employees engaged in setting up and displaying exhibits, making demonstrations, and providing briefings

- Cost of promotional items and memorabilia, including models, gifts, and souvenirs

- Cost of advertising public relations designed solely to promote the SFA

Program Operations, Printing and Reproduction Equipment or Services

- Allowable - materials used to provide notification, maintain records, or other uses related specifically to program objectives

Staff, Cafeteria Monitor

- Allowable - funds used for personnel directly involved in operating or administering Child Nutrition programs who have monitoring duties assigned to them as part of or integral to their regular food service program responsibilities

- Unallowable - funds used to pay meal service monitor salaries for personnel not directly involved in operating or administering the SNP and who do not have monitoring duties assigned to them as part of or integral to their regular CN responsibilities

Staff, College Credits

- Unallowable - cost incurred by an individual to obtain the college credits needed to meet the hiring professional standards

Staff, Employee Recognition

- Allowable - reasonable expenses for recognizing employee efforts in the following conditions:

- Activity is a part of the SFA’s established practice

- The recognition is for employees who work directly for the food service program or whose salaries are paid out of the nonprofit food service account

- Activities or items are intended to improve employee performance

- Activities or items are intended to improve employee-employer relations

Staff, Fringe Benefits

- Allowable - benefits for employees such as the following: leave, insurance, pension, and unemployment plans provided the following criteria are met:

- Established in written policies

- Equitable allocation for related activities for all programs

- Appropriate accounting procedures are in place

- Unallowable - benefits that include use of an automobile for personal use of an employee, including transportation to and from work, whether the cost is direct or indirect cost to the program and whether the cost is reported as taxable income to the employee

Staff, Labor

- Allowable -

- Payments for labor and other services directly related to food service operation

- This includes employer’s share of retirement, social security, insurance payments, and fringe benefits as well as severance required by law, employer‐employee agreement, established institutional policy, or circumstances of the particular employment.

- Prorated portion of the salaries of janitorial, maintenance workers, secretarial, and finance staff for services performed specifically for the SNP operation

- Payments for labor and other services directly related to food service operation

Staff, Memberships, Subscriptions, and Professional Publications

- Allowable - fees for memberships, materials, subscriptions, and professional activities used to benefit or improve the operation of the food service program

- Unallowable -

- Fees for memberships in any civic or community organization as well as country club or social or dining club or organization

- Costs for membership in organizations whose primary purpose is lobbying

Staff, Personal Use

- Unallowable - costs of goods or services for an employee’s personal use even if reported as taxable income to the employee

Staff, Training and Conferences

- Allowable - costs of meeting and conferences for which the primary purpose is the sharing of technical information including meals, transportation, facility rental, speaker’s fees, identification of dependent-care resources, and conference registration fees

- This also includes the costs associated with meeting the professional standards requirements.

- Unallowable -

- Costs associated with obtaining a degree to meet the hiring standards

- Costs for daycare for employees attending training or conference

Transportation, Meal Production Related Activities

- Allowable - reasonable costs associated with purchasing, transporting, and disposing of food items, meals, or stored items used to support the food service program

Travel, Conferences and Training

- Allowable - expenses incurred for staff travel related to improvement of the food service program and to meet the professional standards requirements, such as workshops, conferences, and training programs

Special Situations

Allocable Cost Charges to Other Federal Awards

Any cost to a particular federal award that is allocable may not be charged to other federal awards to overcome fund deficiencies; to avoid restrictions imposed by federal statutes, regulations, or terms and conditions of the federal awards; or for other reasons. However, this prohibition would not preclude a SFA from shifting costs that are allowable under two or more federal awards in accordance with existing Federal statutes, regulations, or the terms and conditions of the federal awards.

Bad Debt

Bad debt is defined as debts which have been determined to be uncollectable. Bad debt is an unallowable cost to the program. The SFA must resolve any negative balance (including net cash resources) to the food service program with non-program funds at the end of the school year. Once debt is determined to be uncollectable any cost associated with legal services for that debt are also unallowable.

Bad Debt, Outstanding Student Debt

Outstanding student debt resulting from nonpayment of school meals or milk is an unallowable cost to the nonprofit school food service account and cannot be absorbed by the food service program at the end of the school year. It must be paid for with other non-federal sources.

Changing Funding Source for a Payment

If a SFA pays a bill with funds from the nonprofit food service account that was not previously charged to the nonprofit food service account, the SFA must add an equal amount of nonfederal funds to the SNP account for the payment to be an allowable cost.

Employee Timekeeping

SFAs are expected to ensure that salary and wage expenses are correctly charged to the nonprofit food service account. SFAs must have a timekeeping record system, paper or electronic, that accurately reflects the work performed by employees for the nonprofit food service program.

The timekeeping record system must meet the following requirements:

- Be supported by a system of internal controls which provides reasonable assurance that the charges are accurate, allowable, and properly allocated.

- Be incorporated into the SFA’s official records that include a hand signature by the employee and the supervisor certifying the accuracy of the records.

- Comply with the established accounting policies and practices put in place by the SFA to ensure program integrity.

The timekeeping record system must provide the following information:

- Actual hours worked, not estimated hours worked, for both hourly and salaried employees compensated by the SFA for each pay period, integrating compensation provided by CN funds and non-CN funds.

- Distribution of the employee’s salary or wages among specific activities or cost objectives if the employee works on CN and non-CN projects.

Capital Expenditures

A capital expenditure is an expense of $5,000 or more for an item that is to be used for general purposes and is intended to be used for multiple years. For capital expenditures, SFAs must use the following guidance:

- Prior Approval - before making a capital expenditure, the SFA must submit a request to CNPA; the SFA must have CNPA approval before purchasing the capital expenditure item.

- Capital Improvements - capital expenditures for improvements to land, buildings, or equipment which materially increase their value or useful life are unallowable as a direct cost except with the prior approval of NYSED.

- Charge Period - capital expenditures must be charged in the period in which the expenditure is incurred unless NYSED approves a payment structure that spans multiple funding years.

- Direct Cost - capital expenditures must be coded as a direct cost; they cannot be classified as an indirect cost.

- Procedure to Request a Capital Expenditure - to request a capital expenditure, SFAs must complete the capital expenditure form.

Equipment/Property, Care and Maintenance

SFAs must use the following guidance for equipment /property purchased with CN funds:

- Must retain equipment property records that include the following information:

- Description of the equipment/property

- Serial number of other identification number

- Source for the equipment/property

- Entity holding the title, if applicable

- Acquisition date

- Cost of the equipment/property

- Location

- Percentage of federal funds in the cost of the equipment/property

- Disposition data including the date of disposal and sale price of the equipment/property if sold.

- Must take a physical inventory of the equipment/property, and the results reconciled with the records at least every two years.

- Must develop a control system to ensure adequate safeguards to prevent loss, damage or theft of the equipment/property. Any loss, damage or theft must be investigated.

- Must develop adequate maintenance procedures to keep the equipment/property in good condition.

Equipment/Property, Disposal

Disposition of equipment/property should follow these requirements:

- Items Valued Less Than $5,000 - Items of equipment/property with a current per unit fair market value of less than $5,000 may be retained, sold or otherwise disposed of with no further obligation to the SFA.

- Items Valued More Than $5000 - Items of equipment/property with a current per unit fair market value in excess of $5,000 may be retained or sold. If sold and child nutrition funds paid the total cost of the equipment, the nonprofit food service account must be credited for the full amount received for the equipment/property. If sold and the nonprofit food service account paid a percentage of the total cost for the equipment/property, the NPFSA must receive a portion of the sale price (percentage of cost) that is equal to the portion the NPFSA paid (percentage of cost) toward purchase—multiply the current market value or proceeds from sale by NPFSA share of the equipment/property.

- Retired Equipment/Property That Will Not Be Replaced - Equipment/Property purchases for use in child nutrition programs must be used by the SFA in the program(s) for which it was acquired for as long as it is needed. When equipment/property is no longer needed by the SNP and will not be replaced, other USDA programs have first preference in using the equipment/property. If another program uses the retired equipment/property, the use of the equipment/property must not interfere with the work of the SNP.

- Retired Equipment/Property That Is Replaced - If acquiring replacement equipment/property, the SFA may also use the retired equipment/property as a trade-in or sell the property and use the proceeds to offset the cost of the replacement equipment/property.

The SFA must establish proper procedure for the sale of retired or replace equipment/property to ensure the highest possible return if the equipment/property is sold or donated. All funds from the disposition of equipment/property must be deposited into the nonprofit food service account.

Nutrition Education Expenses

Nutrition education and related activity expenses are allowable if the expense meet the following criteria:

- Are reasonable, necessary and allocable as defined in this section.

- Support the operation of and/or improvement of the SNP objectives to serve nutritious meals that meet the meal pattern.

Universal Free Feeding Programs

SFAs may choose to allow sites to provide meals to all students at no charge—universal free feeding—at breakfast, lunch, both breakfast and lunch, or afterschool snack. SFAs may operate universal free feeding under the Community Eligibility Provision (CEP), Special Provision 2 (P2), or under standard counting and claiming.

If the SFA adopts a universal free feeding program, the SFA agrees to supplement SNP funds with nonprogram funds if the cost of operating the universal free feeding program exceeds the revenue of the SNP.

Farm to School and School Farm or Garden Expenses and Revenue

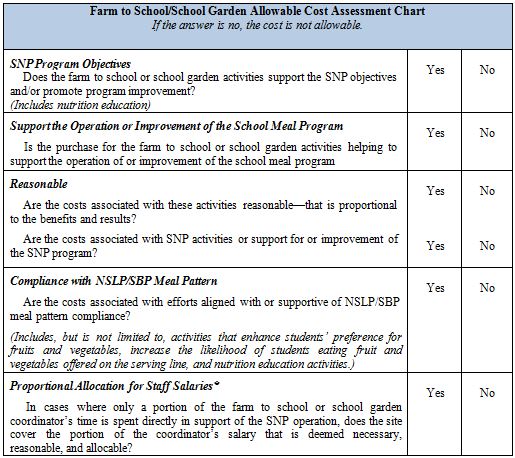

SNP funds may be used to support farm to school activities, including school gardens, if the expenditure is an allowable cost. The Farm to School/School Garden Allowable Cost Assessment Chart may be used by the SFA to determine if the farm to school or school garden expenses are allowable.

Supplies or Equipment for School Farms or Gardens

If the school farm or garden is used within the context of the school meal programs and serves the purpose of supporting the operation of or improving the school meal program, supplies and equipment for the school farm or garden may be purchased with funds from the SNP account. Supplies (i.e., seeds, fertilizer, water cans, or rakes) and equipment (i.e., hoop houses and high or low tunnels) are allowable if (1) the SFA has assessed the purchase using the questions from the Farm to School/School Garden Allowable Cost Assessment Chart and determined that the costs are allowable and (2) the products grown in the school garden or farm are used within the context of the SNP.

Procured Farm to School Products

SFAs may conduct procurement for garden produce even if the purchase falls below the small purchase threshold. Geographic preference may be used. The SFA must still ensure that products purchased from the garden are purchased at reasonable prices.

Sale of Produce from a Garden Funded by the SNP

If the SFA sells produce from a school garden or farm that is funded by the SNP, the revenue must accrue back to the SNP account. If the SFA contributes a proportion of the total cost, the amount accrued back to the SNP may be proportional to the amount of the SNP’s contribution.

Use of Fresh Fruit and Vegetable Program Funds (FFVP)

SFAs must not use funds from the FFVP to purchase supplies or equipment for school gardens.